Why Invest in Multifamily Real Estate?

Passive Income

Earn steady, recurring cash flow without the day-to-day hassles of managing properties. Multifamily investments allow you to generate income while you sleep, creating financial stability and freedom.

Wealth Creation

Multifamily real estate is a proven strategy for long-term appreciation and equity growth. Your investment not only earns rental income but also gains value over time.

Cash Flow

One of the biggest benefits of real estate investing is consistent monthly income. With multifamily properties, rental revenue often exceeds expenses, creating positive cash flow.

Diversification

Avoid putting all your money into stocks and bonds. Multifamily real estate adds tangible assets to your portfolio, reducing risk and enhancing financial security.

Tax Advantages

Real estate investing offers powerful tax benefits, including depreciation, deductions, and deferrals that can maximize your returns and lower taxable income.

Scalability

Unlike single-family properties, multifamily investments grow your wealth faster by allowing you to scale up—adding more units, increasing revenue, and expanding your portfolio efficiently.

About Next Level Capital

At Next Level Capital, we empower investors to achieve financial freedom through multifamily real estate investments. Our mission is to help busy professionals generate passive income, secure their retirement, and build lasting wealth—without the complexities of managing properties.

With a proven track record in real estate investing, we simplify the process for you, providing strategic opportunities that maximize cash flow, equity growth, and tax benefits. Whether you’re a first-time investor or looking to expand your portfolio, we offer expert guidance and hands-off investing opportunities tailored to your financial goals.

Open Investment Opportunities

Avondale Commons

Avondale Commons is an exclusive off-market multifamily investment in Phoenix's booming West Valley. This property offers 324 Class A units in a prime location, positioned in the #1 growth market in the U.S. A rare opportunity for accredited investors seeking passive income and long-term growth in one of the hottest real estate markets.

Avondale Hills

Avondale Hills features 240 units and a 90% occupancy rate—considerable organic rent growth potential with an immediate $30+ per unit. This A-class asset is strategically located in a hyper-connected area along the path of progress, directly across from the MARTA transit station.

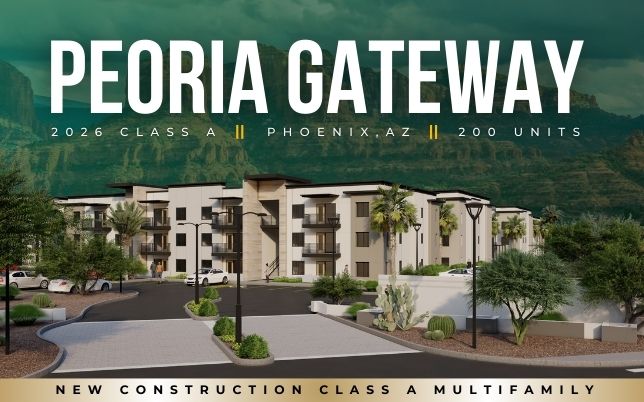

Peoria Gateway

Peoria Gateway is a luxurious 200-unit apartment community set to debut in 2026 in the rapidly growing city of Peoria, Arizona. This premier development is a topcier Class A property, offering state-of-theart amenities that elevate the living experience in a supply-constrained rental market.

The Hamilton

The Hamilton is a 232-unit, light value-add multifamily community built in 1985 and located in Hendersonville, Tennessee—one of Nashville’s most desirable, supply-constrained submarkets. Known for its top-rated school district and strong demographics, Hendersonville offers exceptional rent growth potential driven by limited new construction and robust tenant demand.

Meet Don Goff

— Founder, Next Level Capital

Don Goff is the Founder and Principal of Next Level Capital, dedicated to helping busy professionals generate passive income, secure their retirement, and build lasting wealth through multifamily real estate investments.

If you’re looking to invest in real estate but don’t have the time to find, acquire, and manage properties, Don’s “Hands-Off” income strategy makes it possible. With his expertise, you can enjoy the financial benefits of multifamily investing without the hassle of day-to-day management.

With a foundation in engineering and a passion for empowering others, Don Goff brings a diverse and accomplished background spanning engineering, real estate, health and wellness, and philanthropy.

ENGINEERING

Don holds a Bachelor of Science degree in Mechanical and Biomedical Engineering from Worcester Polytechnic Institute, graduating with distinction. He spent nine years as a Mechanical and Thermal Design Engineer**, earning a U.S. patent during his tenure.**

His analytical expertise and innovative approach laid the groundwork for his entrepreneurial success.

REAL ESTATE

For the past 19+ years, Don has served as a Business Coach for ReMentor, mentoring over 1,800 investors on how to acquire and finance $5–10 million apartment complexes to build leveraged income streams. He has been a featured trainer before audiences of 700+, has raised millions of dollars in capital, and has partnered on over 1,500 multifamily units. Don also created ReMentor’s multifamily and RV park underwriting templates, has his own underwriting education program, and has developed key resources that continue to shape the organization’s mentorship and education programs.

PHILANTHROPY

As Cofounder and Cocreator of Flag for Hope, Don leveraged the skills he honed in real estate to facilitate access and collaboration with some of America’s most iconic figures, including Muhammad Ali, Sandra Day O’Connor, Tom Selleck, Jack Nicklaus, Smokey Robinson, General Colin Powell, Gloria Estefan, dozens of Olympians (many gold medalists), and hundreds of veterans.

Business Mentoring Experiences

Frequently Asked Questions (FAQs)

Who can invest with Next Level Capital?

Anyone looking to build passive income through real estate can invest. Whether you’re a first-time investor or experienced in real estate, our approach allows you to earn without managing properties.

How do I start investing?

Getting started is simple:

- Join our investor network by signing up.

- Review high-performing opportunities that we identify.

- Invest and start earning passive income while we handle everything else.

Do I need prior real estate experience?

No! Our approach is designed to be completely passive, so no prior experience is required. We identify, acquire, and manage the properties for you.

How does multifamily real estate generate passive income?

Multifamily properties generate rental income, which covers expenses and provides consistent returns. Investors receive quarterly distributions and benefit from long-term appreciation.

What kind of returns can I expect?

While returns vary by deal, multifamily real estate typically provides:

- Stable cash flow through rental income.

- Equity growth as the property appreciates.

- Tax benefits through depreciation and deductions.

How often will I receive payouts?

Investors typically receive quarterly distributions based on the rental income generated by the property.

Is real estate investing risky?

All investments carry some level of risk, but multifamily real estate is one of the most stable investment classes. Unlike stocks, real estate offers tangible assets, predictable cash flow, and inflation protection.

What happens if the market declines?

Multifamily real estate is historically resilient. Even in downturns, rental demand remains strong, ensuring continued cash flow. Our focus is on high-performing markets to minimize risk.

Can I invest using my retirement account?

Yes! Many investors use Self-Directed IRAs (SDIRAs) or Solo 401(k)s to invest in real estate, allowing them to grow their retirement savings tax-efficiently.

What is the minimum investment amount?

Minimum investment amounts vary per opportunity. Contact us to learn about the latest investment options.

Will I need to manage the property?

No! Our investment model is fully passive. We handle everything—from property acquisition and tenant management to performance updates and distributions.